When I hear "buybacks," I instantly think of $HYPE.

But which others are worth paying attention to?

🧵

II. Buybacks are effective for mature protocols with steady revenue and growth plateaus.

Great examples include @aave, @ethena_labs, and @0xfluid, which have built their foundations and are now able to return excess cash to holders.

III. However, when early-stage protocols focus on buybacks, it often signals misplaced priorities.

Their treasury should prioritize funding development, partnerships, and ecosystem growth.

Chasing price pumps instead of building products rarely ends well.

IV. Let's start with @HyperliquidX, which is generating more than $1.2B in net income, surpassing NASDAQ's 2024 net income of $1.13B.

"Wo..."

It achieves this with a workforce 832 times smaller, while directing 98% of revenue to $HYPE buybacks. :)

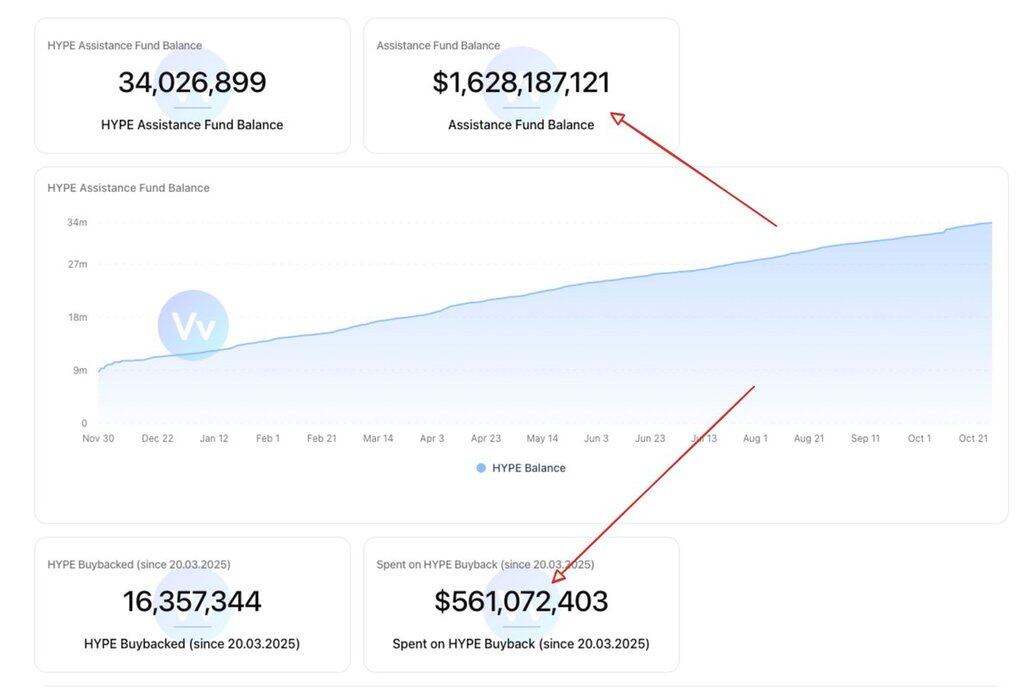

@asxn_r V. Currently, their assistance fund holds $1.62B, with a total of $561M spent on buybacks.

"So, over $1 billion still left for buybacks?"

Exactly.

VI. "Interesting..."

Next up is @aave, whose DAO has recently proposed an annual buyback program with a budget of $50M.

The weekly execution range is $250K to $1.75M in $AAVE buys.

VII. These buybacks will be facilitated by market makers, buying $AAVE on secondary markets, and then distributing it to the Aave Ecosystem Reserve.

FYI: @aave already bought back around 0.5% of supply.

IX. Also, I believe it's worth paying attention to @0xfluid, @ethena_labs, @JupiterExchange, @ResolvLabs, and some protocols on @solana which Fabiano outlined below:

X. And I'm surely not paying attention to @GMX_IO, @movementlabsxyz, @Ronin_Network, @LayerZero_Core, @SkyEcosystem, @metaplex and @OfficialApeXdex.

Bois, what are your thoughts on buybacks?

@splinter0n @0xDefiLeo @the_smart_ape @0xCheeezzyyyy @DOLAK1NG @YashasEdu @0xAndrewMoh @eli5_defi @_SmokinTed @RubiksWeb3hub @kenodnb @rektonomist_

6,94 mil

40

El contenido de esta página lo proporcionan terceros. A menos que se indique lo contrario, OKX no es el autor de los artículos citados y no reclama ningún derecho de autor sobre los materiales. El contenido se proporciona únicamente con fines informativos y no representa las opiniones de OKX. No pretende ser un respaldo de ningún tipo y no debe ser considerado como un consejo de inversión o una solicitud para comprar o vender activos digitales. En la medida en que la IA generativa se utiliza para proporcionar resúmenes u otra información, dicho contenido generado por IA puede ser inexacto o incoherente. Lee el artículo vinculado para obtener más detalles e información. OKX no es responsable del contenido alojado en sitios de terceros. El holding de activos digitales, incluyendo stablecoins y NFT, implican un alto grado de riesgo y pueden fluctuar en gran medida. Debes considerar cuidadosamente si el trading o holding de activos digitales es adecuado para ti a la luz de tu situación financiera.