Spot Margin Arrives in Europe: How OKX Is Building the Products Traders Want

Written by Erald Ghoos, CEO of OKX Europe

Over the past year, OKX has been steadily expanding across Europe — we're listening to what traders want and building the products they need. From advanced trading tools to deeper liquidity and new institutional partnerships, Europe has quickly become one of the most important regions driving OKX’s global growth.

Today, we’re excited to take another major step forward with the launch of Spot Margin trading in Europe — bringing powerful, high-performance margin tools to customers across the EEA.

Why Spot Margin, and Why Now?

For years, Spot Margin on OKX’s global platform has been one of the most trusted systems in the industry — built for speed, transparency, and risk-managed performance. European customers have been asking for access to this same battle-tested infrastructure, and today we’re delivering exactly that.

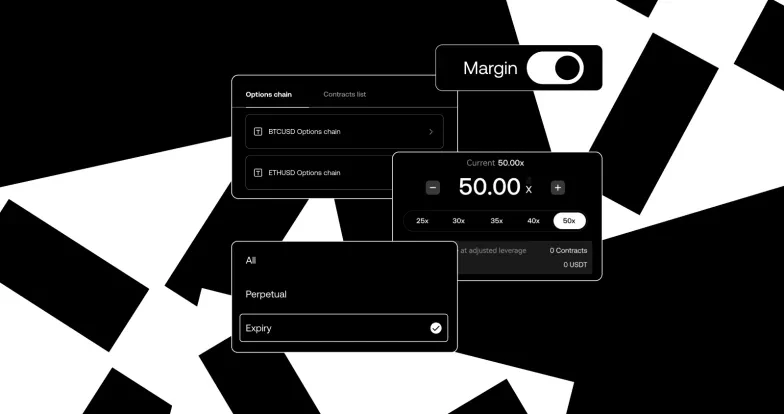

Spot Margin on OKX Europe includes:

Up to 10× leverage on BTC, ETH, and USDC trading pairs

Long and short positions, enabling hedging strategies

Cross-margin mode, allowing a user’s full portfolio to count as collateral

Trading via an independent unified USD EEA orderbook engineered for deep liquidity and fast execution

This release isn’t just about adding a new product — it's about bringing European traders into the same high-performance environment that global customers rely on every day.

Expanding the OKX Product Universe in Europe

Spot Margin is only the latest chapter in a broader expansion. Over the past year, OKX has continuously introduced new trading, investment, and on-chain capabilities designed specifically for European customers. The feedback has been clear: customers want more optionality, more powerful tools, and more ways to participate in fast-moving markets.

Some want leverage to amplify opportunities.

Some want hedging tools to protect positions.

Some want institutional-grade liquidity and execution.And many simply want access to the same OKX features that have become staples across other regions.

Spot Margin is the direct result of what customers have been consistently asking for — and it's only the beginning.

Partnerships That Strengthen the Ecosystem: Standard Chartered and Beyond

As OKX’s European presence has grown, so has the strength of its institutional ecosystem. Partnerships with major global financial institutions — including Standard Chartered — reflect a growing connection between established finance and the next generation of digital trading.

Such collaborations are not just symbolic. They expand access to liquidity, improve market infrastructure, and help ensure customers have the depth and reliability they expect from a top-tier trading platform.

The message is clear: Europe is becoming a hub where traditional finance and digital assets meet, and OKX is at the center of that momentum.

Built for Traders — Powered by Community Feedback

One thing has never changed at OKX: our roadmap starts with our customers.

Spot Margin was one of the most requested features from European traders, and this launch shows how seriously we take user feedback. Whether it’s improving liquidity, adding new trading pairs, or expanding tools for strategy and risk management, OKX Europe is shaping its product lineup based on real customer needs.

Europe is a tier-1 region for OKX. By bringing Spot Margin to OKX Europe, we’re giving customers access to the same high-quality infrastructure trusted globally, while meeting the expectations of our fast-growing community.

What’s Next for OKX in Europe?

Spot Margin is a milestone — but it’s far from the final destination.

Over the coming months, OKX will continue expanding its lineup of trading tools, deepening liquidity partnerships, and building features designed specifically for European traders. As the region’s crypto community grows, OKX is committed to growing alongside it by delivering products that are powerful, intuitive, and built for real market needs.